Key Takeaways

- Fleet insurance costs are rising because insurers lack visibility into real driving behavior and risk.

- Telematics data (speeding, harsh events, mileage, routes) gives insurers objective proof of safer operations.

- Organized incident reporting and fast claims documentation reduce disputes and prevent inflated liabilities.

- Tracking KPIs like incident rate, CPM, and driver scores strengthens negotiations during renewals.

- Fleets using telematics and analytics consistently see lower claims, better safety outcomes, and reduced insurance premiums.

Insurance has become one of the most expensive and unpredictable operating costs for fleets. Industries like construction, car rental, HVAC, and field service face heightened exposure - frequent trips to client locations, unpredictable driving environments, and diverse vehicle types all increase risk.

Without clear data, insurers default to conservative assumptions. That often means higher premiums, slow claims processing, and limited negotiation power for fleets.

Common issues include:

- No structured way to document incidents

- Inability to disprove false liability

- Missing maintenance evidence

- Delayed claims filing

- Lack of visibility into daily driver behavior

- Multiple insurers assuming the fleet is “high risk”

These challenges also impact overall fleet operations, from compliance to customer satisfaction. Many fleets already explore how insurance works at a base level, such as understanding fleet insurance fundamentals, but the real advantage comes from using operational data to reshape your risk profile.

Why Insurance Pricing Needs Better Fleet Data

Insurers evaluate fleets using factors like vehicle type, driving patterns, claim history, service area, and total exposure. When they lack evidence, they assume the risk is high.

Telematics changes that equation.

Through data signals (speed, braking, idle time, routes, location, mileage, engine health) fleet teams can demonstrate a measurable drop in risk. This allows insurers to objectively reassess premiums.

By connecting these insights with strong operational processes like building an effective fleet operation, fleets establish a clear, data-backed safety culture.

How Telematics Strengthens Your Insurance Position

Telematics provides a layer of visibility that insurers trust because it removes guesswork.

Key Data Insurers Consider

- Frequency of speeding

- Harsh braking or acceleration

- Night driving exposure

- Route patterns

- Idle behavior

- Crash alerts

- Mileage trends

- Vehicle health

How This Data Reduces Premiums

- Objective evidence for claims: GPS logs, telematics events, and dashcam clips provide timestamped proof that settles disputes quickly.

- Lower frequency and severity of claims: Driver scorecards, alerts, and coaching reduce risky behavior.

- Predictive maintenance: Engine alerts and scheduled servicing prevent avoidable breakdowns.

- Better control of exposure: Mileage, trip logs, and route insights help fleets reduce high-risk journeys.

- Faster reporting: Insurers reward fleets that close claims faster with fewer discrepancies.

Each of these improvements helps insurers revisit pricing models, often resulting in meaningful savings.

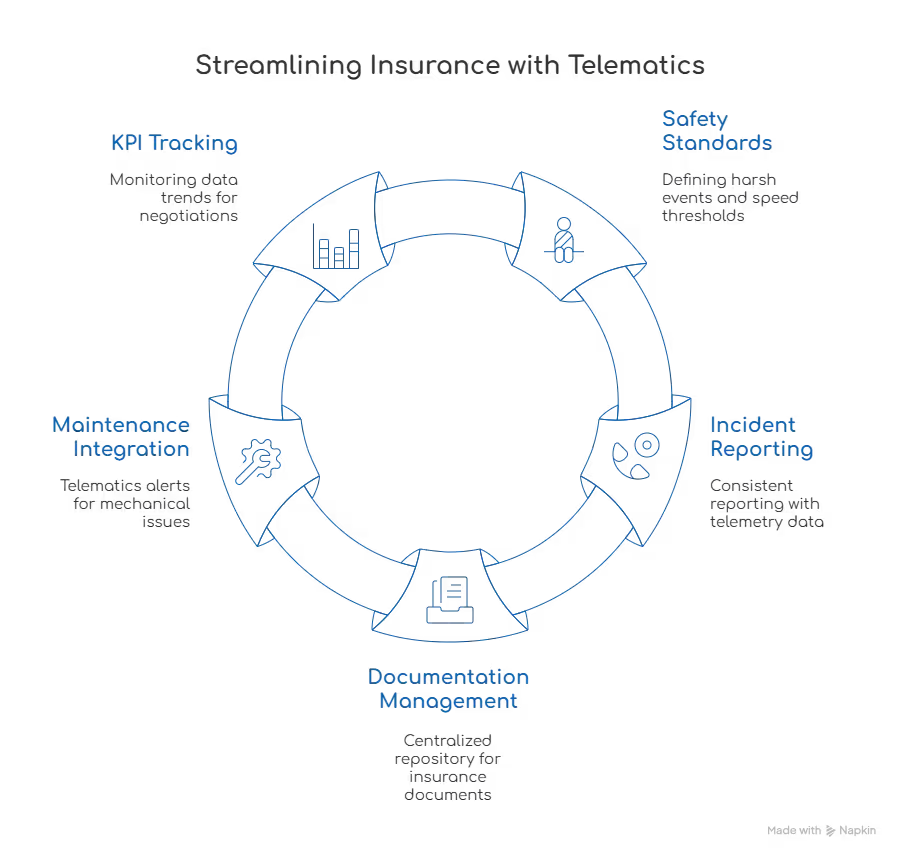

Building a Telematics-Driven Insurance Workflow

Telematics is only effective when paired with consistent reporting and documentation. Here’s a streamlined workflow fleets can adopt:

Establish Safety Standards

- Define what constitutes harsh events

- Set threshold speeds for urban, rural, and highway routes

- Enforce regular driver coaching

- Share expectations clearly during onboarding

Standardize Incident Reporting

Every incident (even minor bumps) should follow a consistent template. A strong workflow includes:

- Immediate driver submission via mobile app

- Mandatory photos/videos

- Telemetry snapshot (speed, brake, impact, GPS)

- Clear notes describing the event

This reduces inconsistencies that insurers often question.

Maintain Updated Insurance Documentation

COIs, endorsements, liability limits, and vehicle schedules must be easily accessible. A centralized repository ensures nothing is missed during audits or renewals.

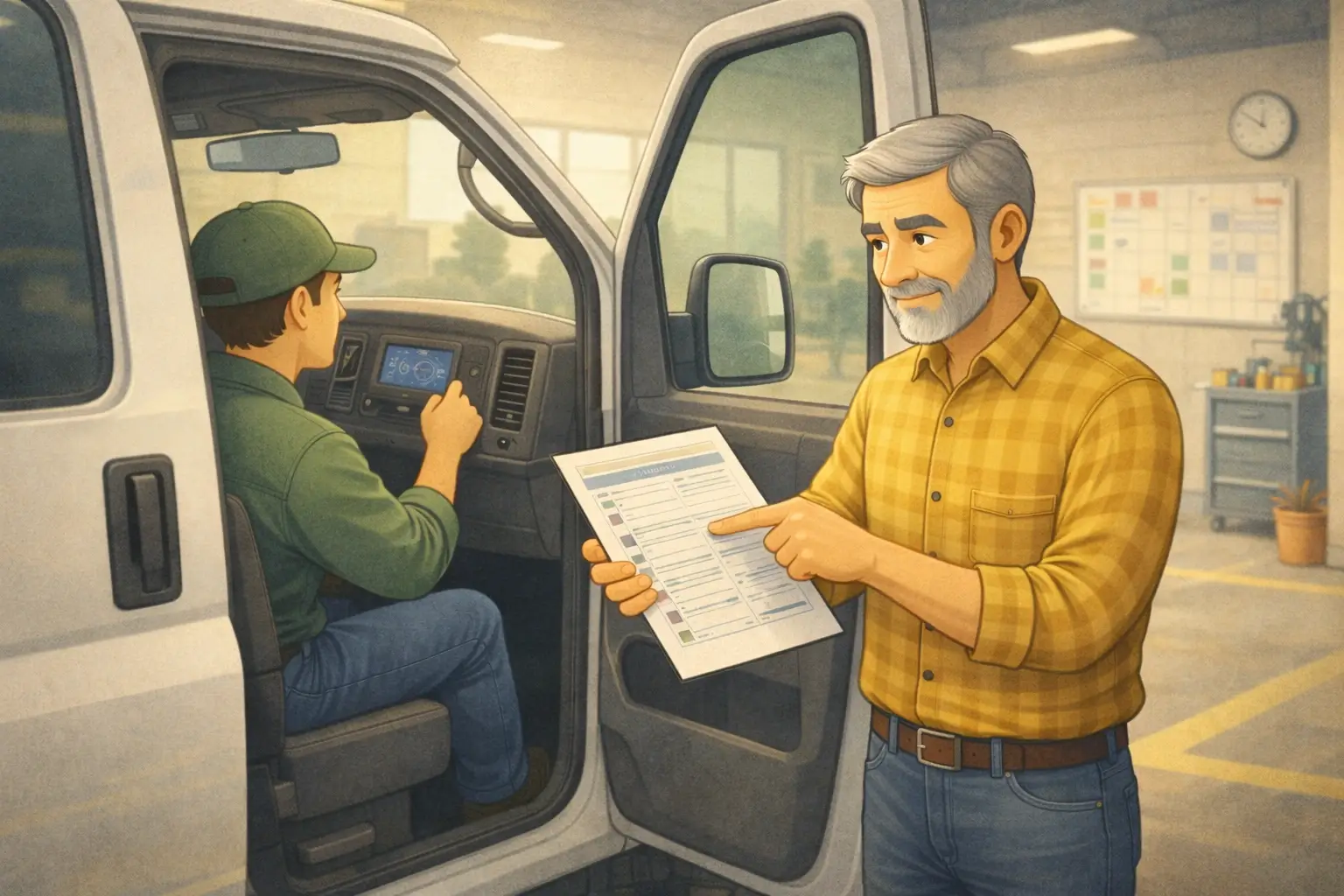

Connect Data With Maintenance

Telematics alerts help reduce accidents caused by mechanical issues. This practice complements the basics of performing a thorough vehicle inspection.

Track Insurance-Impacting KPIs

Data trends over time are extremely valuable during negotiations.

The KPIs That Matter Most for Insurance

These indicators create a measurable picture of fleet health and risk:

- Incident Rate: Number of reported incidents per 100,000 miles.

- Harsh Events per 100 Miles: Shows the frequency of risky actions.

- Average Claim Cycle Time: Shorter duration = better insurer trust.

- Cost per Mile (CPM): Includes repair, downtime, and insurance impact.

- Driver Safety Score: A consistent improvement is a strong negotiation tool.

- Vehicle Health Compliance: Timely maintenance reduces accident likelihood.

Tracking these KPIs alongside broader operational systems (such as those outlined in a comprehensive fleet insurance guide) helps fleets build a complete risk story.

COI Checklist & Claims SOP

COI Checklist

Store and update the following:

- Commercial Auto Liability

- General Liability

- Workers’ Compensation

- Hired/Non-Owned Auto

- Physical Damage Coverage

- Limits and endorsements

- Policy expiration alerts

- VIN-level coverage verification

- Insurer contact and broker details

Internal Claims SOP

- Step 1: Report the incident immediately

- Step 2: Add images, telematics data, and driver statements

- Step 3: Classify severity and potential liability

- Step 4: Submit to insurer within 24–48 hours

- Step 5: Track claim status weekly

- Step 6: Conduct root-cause analysis and update safety guidelines

Download Our Free Fleet Inspection Resources Now!

How Telematics Lowers Premiums — Summary Table

Lower Your Premiums With Simply Fleet

A safer fleet is built through data. Telematics, reporting, and structured workflows eliminate the uncertainty that insurers price into premiums. If your fleet wants to lower insurance costs, protect drivers, and improve long-term sustainability, the first step is visibility.

Simplify insurance reporting, reduce claims, and improve safety with Simply Fleet. Track behavior, document incidents, export insurer-ready reports, and build a risk profile that earns better premiums.

Get a free demo of Simply Fleet today.

.png)

.png)

.png)

.avif)

%20(1).avif)